WeWork downfall complete as company files for bankruptcy

New York, New York - Beleaguered shared office giant WeWork, which has been in dire financial straits for years, announced Monday that it had filed for bankruptcy in a bid to negotiate down its debt.

The coworking company said its bankruptcy impacts operations in the US and Canada, but "global operations are expected to continue as usual."

The bankruptcy filing was a stark turn of events for the New York-based company, which was once a startup darling promising to reshape the office sector globally.

It at one point attracted huge infusions from investors, including SoftBank and venture capital firm Benchmark. WeWork was considered the most valuable US startup as recently as 2019, worth $49 billion.

But elusive profitability, the rise of telecommuting, a drop in tenants, and years of massive costs have hit the company hard.

Nonetheless, the company put a positive spin on the bankruptcy news.

"Now is the time for us to pull the future forward by aggressively addressing our legacy leases and dramatically improving our balance sheet," WeWork chief executive David Tolley said in a statement.

"We defined a new category of working, and these steps will enable us to remain the global leader in flexible work."

The rise and fall of WeWork

WeWork had been a celebrated star in the sharing economy, laying down a mammoth footprint in the commercial real estate sectors of major cities around the globe.

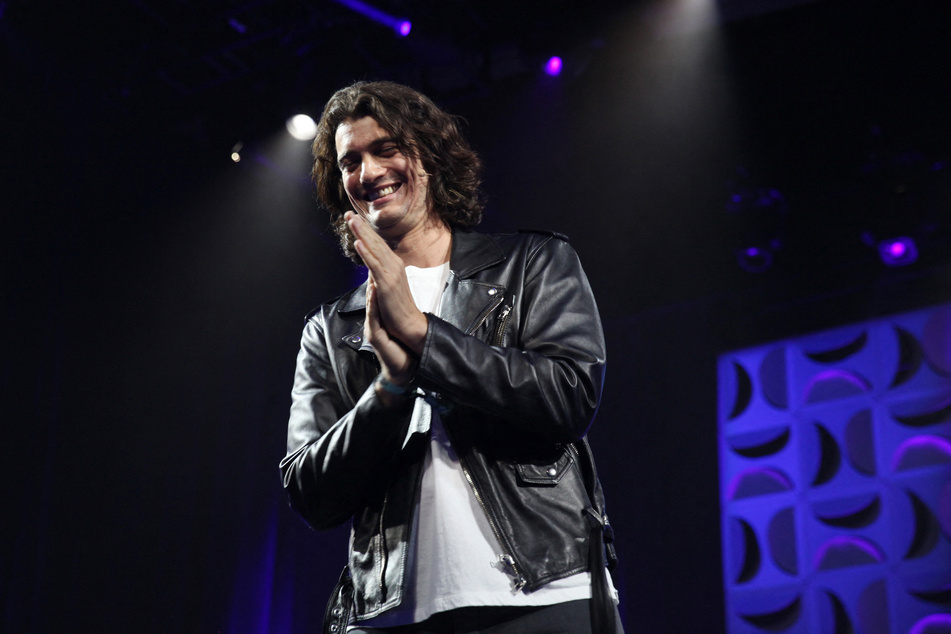

But investors tired of its messianic then-chief executive Adam Neumann, massive operating costs and lack of profits in 2019, when it tried to go public.

The flamboyant Neumann, who started WeWork in 2010, was axed after the initial public offering failed.

WeWork's slide only accelerated during the Covid-19 pandemic, which led to office closures and the rise of work from home.

The company has scrambled to sell off part of its business, renegotiate leases and shut branches, but it still lost more than $1 billion in the first half of 2023.

Cover photo: TIMOTHY A. CLARY / AFP