Report reveals whistleblower complaints of tax dodging at private equity firms

Washington DC – At least three whistleblowers have reported recent cases of alleged tax dodging at private equity firms, once again drawing attention to unequal tax burdens in America.

The New York Times obtained records from three separate whistleblowers laying out tax-avoidance strategies employed by private equity firms. Essentially, the claims accuse the firms of illegally waiving management fees in exchange for collecting shares of future profits, allowing them to pay a much lower tax rate.

But what are private equity firms anyway?

They are a group of investors who get together to borrow money and buy a company. Then they typically sell off assets or let staff go, turn the company around, and sell it for more money than they initially bought it for. After paying off the bank loan, they can split the profits amongst themselves.

Many of the richest Americans are involved in the private equity industry. Nevertheless, US citizens earning less than $25,000 a year are three times more likely to face Internal Revenue Service (IRS) audits, according to the New York Times.

Private equity investors collect profits through partnerships, which are not subject to income taxes. As investigating these wide networks of partners is both time-consuming and expensive, the IRS often doesn't bother.

After all, it's much easier to audit an everyday American just trying to get by than it is to monitor a private equity firm walking away with millions in profits.

But the lack of audits for the richest Americans also has a way greater impact for US government revenues, with losses amounting to around $75 billion per year, according to a recent estimate.

That's nearly double the annual federal spending for education!

Washington has failed to enact substantial reforms

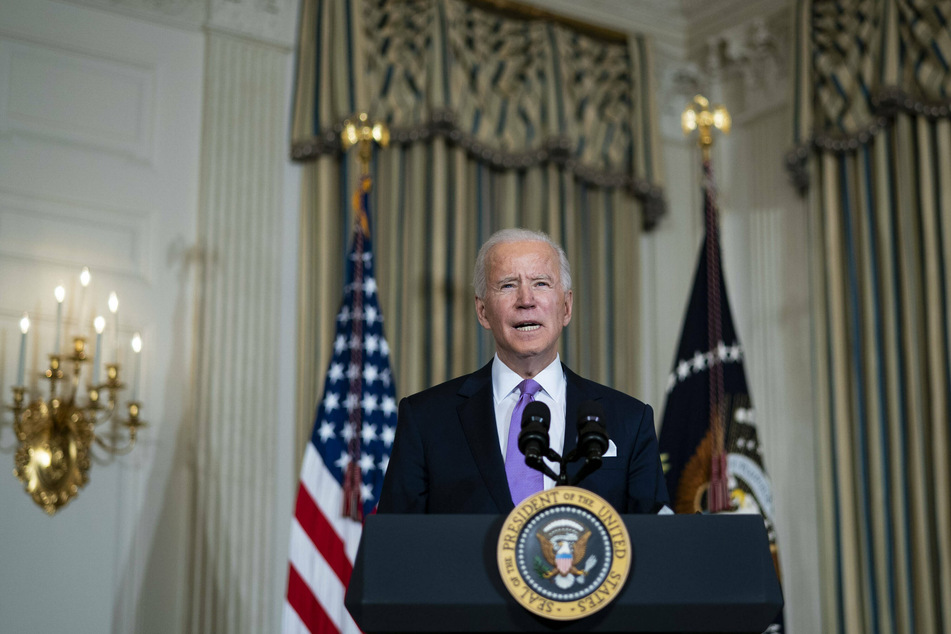

The Biden administration has floated several ideas to increase oversight of private equity firms, including raising the IRS budget and closing loopholes for enforcement.

But Washington has long been ineffectual when it comes to real change in this area. The private equity industry currently has around 200 lobbyists and has invested nearly $600 billion in campaign contributions over the last ten years, the New York Times reported.

It comes as no surprise, then, that many reform bills die in Congress, often without even going to a vote.

After the Obama administration failed to pass sweeping reforms for private equity fee waivers, the Trump administration enacted laws requiring private equity firms to hold investments for a minimum of three years before receiving any preferential tax treatment. The move was widely seen as means of keeping up appearances without actually stripping any power from the firms, as they typically hold their investments for at least five years anyway.

It's also notable that Obama's and Trump's past Treasury secretaries joined private equity firms after they left office.

It remains to be seen whether Biden can have more success than his predecessors. But even if he is able to increase the agency's budget, IRS insiders doubt it will have much effect in the short term: "If the I.R.S. started staffing up now, it would take them at least a decade to catch up," a former IRS attorney explained. "They don’t have enough I.R.S. agents with enough knowledge to know what they are looking at. They are so grossly overmatched it’s not funny."

The New York Times story comes after the publication of a bombshell ProPublica report detailing how little America's wealthiest pay in taxes.

Cover photo: 123RF/taa22