Jeffrey Epstein’s Manhattan mansion sold to fund victims' compensation

New York, New York – After months of delay, Jeffrey Epstein’s prime Manhattan mansion has sold for nearly $51 million – and the estate of the disgraced multimillionaire vows the proceeds will flow to a fund for his victims, some of whom were sexually abused in that very same structure.

The posh mansion is the most expensive property in a portfolio that included a waterfront mansion in Palm Beach, Florida, a New Mexico ranch, two private islands in the Virgin Islands, and a home in Paris.

The sale and price were confirmed late Wednesday as lawyers for the estate engineered an unusual courtroom maneuver, filing a motion that reversed field on a previous position.

They filed court papers siding with a request by the attorney general of the US Virgin Islands, an adversary in long-standing litigation, that she be permitted to amend a civil complaint.

Specifically, lawyers for the estate asked the Superior Court of the Virgin Islands to accept the February 2020 request by Attorney General Denise George to amend her original civil enforcement action against the Epstein estate in order to add co-executors Darren K. Indyke and Richard Kahn as co-conspirators.

George alleged the estate and its executors are an ongoing criminal enterprise and that the two, Epstein’s longtime personal lawyer and accountant, are part of it.

Legal battles have raged over two co-executors of Epstein's estate

The estate had moved to strike the request in March 2020, and the Virgin Islands court received all briefs on the matter in July but more than half a year later has yet to rule. Lawyers for the estate in the motion filed Wednesday and made public Wednesday night asked that the amended complaint simply be accepted.

"Both the Government’s existing claims and its proposed new claims suffer from many of the same infirmities and the Government’s Motion is futile for similar reasons," attorney Christopher Kroblin argued in the filing.

But given how long the matter has dragged on, the estate said it no longer is opposed to amending the original filing and appears to be betting that the court will toss out all efforts to make the estate executors part of the civil enforcement complaint.

"The proposed claims are part of the Government’s concerted effort to frustrate the Co-Executors’ ongoing orderly administration of the Epstein Estate, which recent efforts include not only this Motion, but also the Government’s baseless emergency motion in the Probate Court to freeze all Estate assets," Kroblin wrote, noting that the Superior Court struck down on March 1 the attorney general’s emergency request to freeze all estate assets.

The Wednesday filing was the latest salvo in fierce legal parrying. The attorney general last month added new allegations to her list of complaints, calling Indyke and Kahn "captains" of criminal enterprise that engaged in immigration fraud, forcing American victims to marry foreign victims of Epstein’s sex trafficking activities.

The two denied this.

The funds from the mansion sale with go to Epstein's victims

The head of the special Epstein Victims Compensation Fund announced on February 4 that it was temporarily suspending new offers of compensation to victims until funds were replenished.

The estate blamed liens imposed by Attorney General George for hampering the ability to sell properties to raise funds for victims, something George denied.

The estate and the fund confirmed that between last June and December 31, the estate had paid Epstein victims nearly $50 million. But the most recent update on the estate’s expenses, covering the final three months of 2020, showed the victims weren’t the only ones compensated. Estate taxes totaling $190 million were paid.

In a statement to the Miami Herald Wednesday night, a lawyer for the estate said the fund would soon be replenished thanks to the sale, completed on Tuesday, of the townhouse on 71st Street. The estate confirmed that the townhouse has sold for about $51 million, down from the original listing price of $88 million.

"At the Co-Executors’ direction, funds from the sale are being transferred to the Epstein Victims’ Compensation Program in order to allow that Program to resume issuing new claims determinations," said Daniel H. Weiner, a partner at Hughes Hubbard & Reed representing the estate. "With the ongoing oversight of the U.S.V.I. Court, the Co-Executors continue to engage in the orderly administration of the Estate."

The Epstein victims fund continued to accept requests for compensation. The deadline for filing a claim to seek compensation is March 25.

"The Attorney General’s Office welcomes news that the Victims’ Compensation Fund may resume its work after the disruption created by the Estate when, without prior notice, it failed to make its financial commitment to the Fund," Attorney General George said in a statement late Thursday.

"After the Government filed its Emergency Motion to Freeze the Estate’s Assets, the Estate was directed by the Court to ensure that all proceeds from the sale of Estate assets be placed in Estate accounts subject to liens imposed by the Virgin Islands Government, an important safeguard."

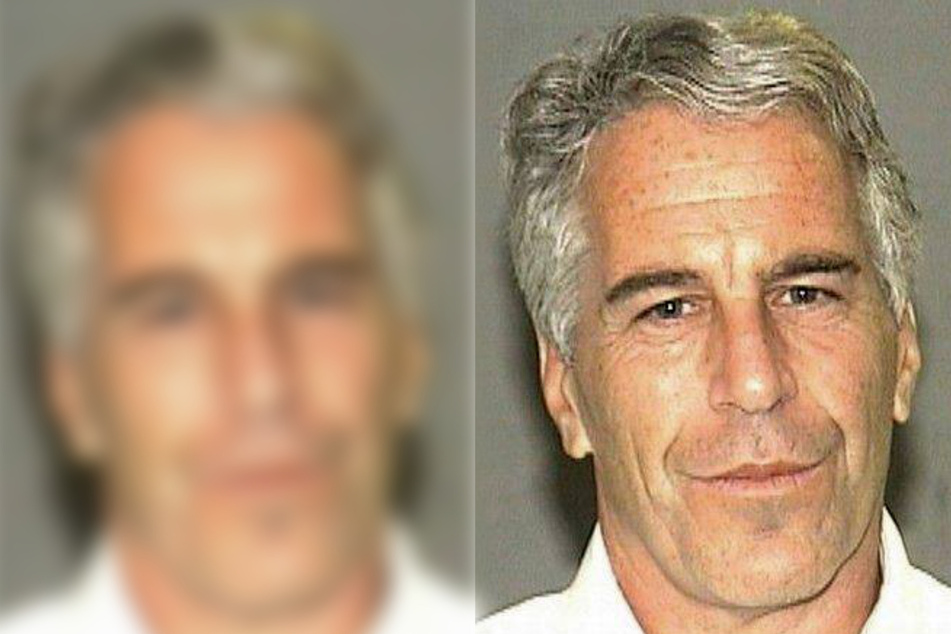

Cover photo: IMAGO / ZUMA Wire