Biden administration announces new plans to discharge student debt in bankruptcy

Washington DC - The Biden administration on Thursday announced plans to make it easier to have federal student loan debt discharged in bankruptcy.

When a person goes bankrupt, their student loans aren't automatically cleared away. Instead, borrowers are expected to go through a complicated and costly process to discharge the debt, which is very unlikely to be successful.

Under the current rules, borrowers are required to prove that their debt causes them "undue hardship," which is difficult to prove.

The Biden administration is now trying to make that process less painstaking. While the "undue hardship" requirement can only be removed by Congress, new federal guidance seeks to make that legal standard easier to show.

Going forward, Justice Department (DOJ) attorneys are expected to allow a discharge if the borrower is not able to pay off their debt because their expenses equal or exceed their income, if that condition is expected to continue, and if they have made "good faith efforts" to improve their financial situation.

"Today’s guidance outlines a better, fairer, more transparent process for student loan borrowers in bankruptcy," said Associate Attorney General Vanita Gupta, according to CNN. "It will allow Justice Department attorneys to more easily identify cases in which we can recommend discharge of a borrower’s student loans."

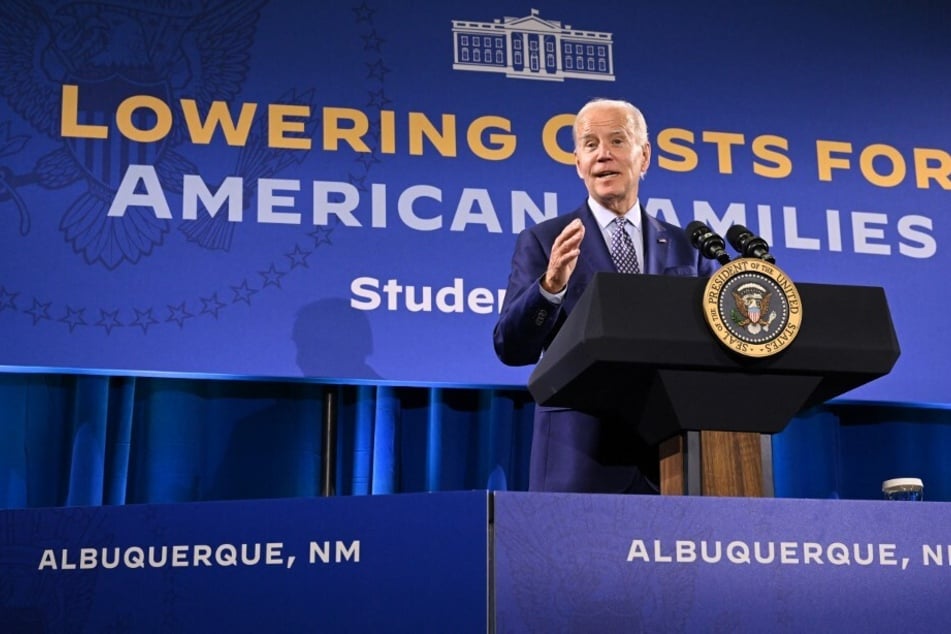

The announcement comes as President Joe Biden's plan to grant up to $20,000 in student loan relief per borrower was struck down by a federal court in Texas last week. The DOJ is appealing the decision.

Student loan payments are set to continue in January unless further federal action is taken. While activists have welcomed Thursday's development, many are still calling on Biden to cancel all student debt by executive order.

Cover photo: SAUL LOEB / AFP