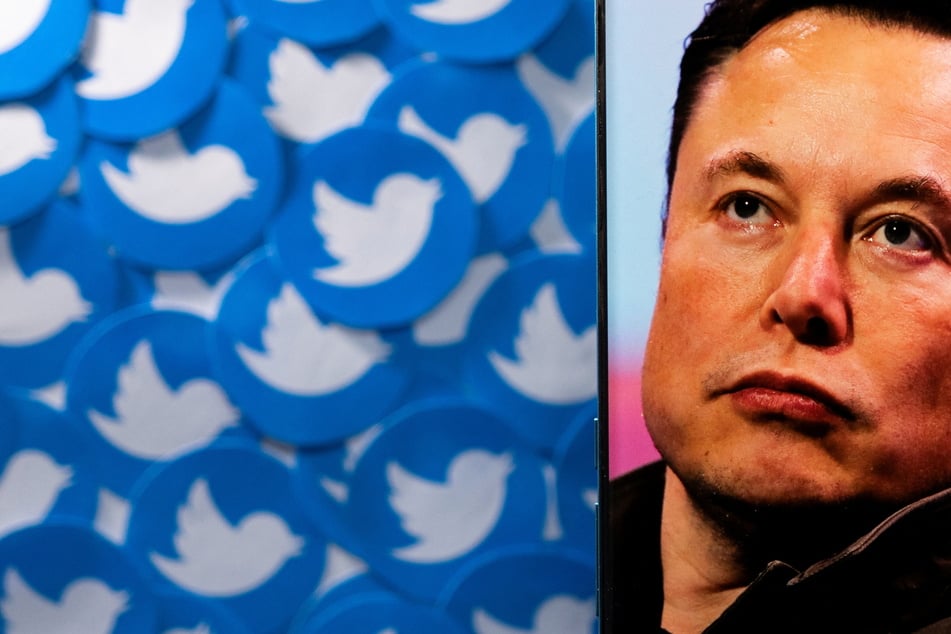

Twitter takeover: SEC questions Elon Musk over late disclosure of ownership stake

Washington DC - The US Securities and Exchange Commission (SEC) is investigating Tesla chief executive Elon Musk on his late disclosure of his stake in Twitter.

According to a letter sent to Musk which has been made public, the regulator asked the billionaire why he did not file required paperwork within 10 days of the acquisition, as required by the law.

"Please advise us why the Schedule 13G does not appear to have been made within the required 10 days from the date of acquisition as required by Rule 13d- (c), the rule upon which you represented that you relied to make the submission," the SEC asks in the letter.

According to Musk's own filing, he passed the 5% threshold on March 14, which means he should have filed the form by March 24.

But Musk declared his acquisition of a 9.2% stake in Twitter only on April 4.

The SEC also asked Musk about the reason behind him initially filing a "13G" disclosure form, which is meant for investors who plan to hold their shares passively, instead of a "13D" form, which is for activist investors.

In late April, Twitter accepted Musk's takeover offer of about $44 billion to become a privately held company.

Musk agreed to pay Twitter shareholders $54.20 in cash for each Twitter share.

But Musk has kept the deal "on hold" as he allegedly seeks more information about the proportion of fake accounts on Twitter.

Cover photo: REUTERS